Market Update 12/03/2023

THE BIG PICTURE: As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bull on April 21, 2023.

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

IN THE MARKETS THE WEEK ENDING DECEMBER 1, 2023:

U.S. Markets: Most of the major indexes ended higher for the week, with the S&P 500 Index and Nasdaq Composite rounding out their best monthly performance since the summer of 2020. The Dow Jones Industrial Average rose by 2.4%, a gain of 855 points, and finished the week at 36,246. The technology-heavy NASDAQ ticked up 0.4%. By market cap, the large cap S&P 500 added 0.8%, while the mid cap S&P 400 grew by 2.5%. The small cap Russell 2000 finished the week up 3.1%. For the month of November, the Dow and Nasdaq gained 8.8% and 10.7%, respectively. By market cap, the S&P 500 advanced 8.9%, mid-caps rose by 8.3%, and small caps added 8.8%.

International Markets: The international indexes finished the week mixed. Canada’s TSX gained 1.7%, while the UK’s FTSE 100 ticked up 0.5%. France’s CAC 40 rose 0.7%, while Germany’s DAX climbed 2.3%. In Asia, China’s Shanghai Composite shed -0.3%. Japan’s Nikkei retreated -0.6%. As grouped by Morgan Stanley Capital International, developed markets gained 0.9% and emerging markets ticked up 0.5%. International markets varied in November. Canada rose 7.2%, while the UK ticked up 1.8%. France and Germany gained 6.2% and 9.5%, respectively. China grew 0.4%, while Japan increased by 8.5%. Developed markets finished the month up 8.2%. Emerging markets increased by 7.8%.

Commodities: Precious metals performed well this week. Gold rose 4.33% to $2,089.70 an ounce and Silver gained 6.23% to $25.86. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, gained 3.76%. West Texas Intermediate crude oil pulled back for its sixth consecutive week giving up -1.95% to $74.07 per barrel. For the month of November, Gold increased 3.15% and silver advanced 11.79%. Copper gained 5.52%, while oil shed -6.24%.

U.S. Economic News:

U.S. new home sales were weighed down by higher mortgage rates in October. Monthly sales increased in the Northeast and South but dropped off in the West, where housing is expensive, and in the most affordable region, the Midwest. The Commerce Department’s Census Bureau said that new home sales, which account for 15.2% of U.S. home sales, fell by 5.6% to a seasonally adjusted annual rate of 679,000 units last month. Most homeowners remain reluctant to sell with their mortgage rates being under 3%. According to data from mortgage finance agency Freddie Mac, the rate on the 30-year fixed-rate mortgage increased to an average of 7.79% in late October. With mortgage rates adding constraint, some economists doubted residential investment would expand in the fourth quarter. “High prices are also weighing on homebuying activity," said Daniel Silver, an economist at JPMorgan in New York.

The S&P CoreLogic Case-Shiller 20-city house price index climbed to an unadjusted 0.2% at the end of the third quarter. Home prices in the 20 major U.S. metro markets were up 3.9% since last year. The national index, a broader measure of home prices, rose to an annualized 3.9% in September as well. Detroit reported the largest year-over-year increase in home prices at 6.7%. San Diego was next up with a 6.5% increase. Prices in New York and Chicago advanced by 6.3% and 6%, respectively. While high interest rates continued to discourage some buyers, there was enough demand to keep home prices elevated. “While supply and demand are reasonably matched, they are still both depressed, and consumers are frustrated by the state of play,” said chief economist Bill Adams of Comerica Bank in Dallas.

Consumer confidence climbed in November from a 15-month low, but recession concerns persisted. The consumer-confidence index increased to 102 from 99 in October, the Conference Board said. A confidence gauge that projects six months ahead rose from 72.7 to 77.8 this month. However, approximately two-thirds of consumers reported a recession in 2024 to be likely. High interest rates, and persistently high prices, have built up consumer pessimism. “Consumers remain preoccupied with rising prices in general, followed by war conflicts and higher interest rates,” said Dana Peterson, chief economist at the Conference Board.

The core personal consumption expenditures price index rose by 0.2% in October. Over the past year, the increase in the core PCE rate slowed from 3.7% to 3.5%. Inflation as measured by the PCE price index was partially held down by a decline in oil prices. Inflation remained above the Fed’s 2% goal, but economists expect rates are high enough to hit the target by 2024/25. “The Fed is on hold for now, but their pivot to rate cuts is getting closer: Inflation is clearly slowing, and the job market is softening faster than expected,” said chief economist Bill Adams of Comerica Bank.

Continuing jobless claims ticked up to the highest level in two years. The number of Americans collecting jobless benefits last week rose by 86,000 to 1.927 million, which marked its highest level since 2021. The Labor Department said initial jobless claims gained 7,000 last week, ending at 218,000. Economists had expected an 11,000 increase. The increase in continuing claims suggested workers who have been laid off are struggling to find new jobs. As jobless claims tend to be volatile around the holiday season, economists are wary to read too much into the data.

The Fed’s Beige Book found that the economy has slowed, alongside inflation. The Federal Reserve survey, known as the Beige Book, found that the U.S. economy softened in November. Six of the twelve Fed regional banks throughout the U.S. reported declined economic activity. Two other banks reported that activity had flattened. “Demand for labor continued to ease, as most districts reported flat to modest increases in overall employment,” the Beige Book said. Across the country, price increases “largely moderated” and “most districts expect moderate price increases to continue into next year,” the Beige Book found. Fed officials pointed to the slowdown in the economy as an indication that higher interest rates reduced the rate of inflation. Economists forecast that, following the 5.2% annual rate of expansion seen in the third quarter, the economy is on track to grow between 1% and 2% by the end of the year. Cleveland Federal Reserve President, Loretta Mester, said interest rates are positioned to reach the Fed’s long-term goal of reducing inflation to 2%.

The Institute for Supply Management’s manufacturing survey was negative in November. The ISM survey, a barometer of business conditions at U.S. factories, was unchanged at 46.7%. Economists had forecasted a reading of 47.7%. The production barometer dropped 1.9 points to 48.5%, the index of new orders gained 2.8 points to 48.3%, and the prices index rose 4.8 points to 49.9%. As high rates discouraged consumer purchases last month, businesses cut back investments. Survey Chairman Timothy Fiore said, “Demand remains soft.”

International Economic News:

The Canadian economy added more jobs than expected in November. Statistics Canada reported the country gained a net 24,900 jobs last month, while the jobless rate ticked up to 5.8%. November’s employment gains were in full-time work, while part-time positions declined. Employment in goods sectors added a net 38,300 jobs, primarily led by manufacturing. Meanwhile, services sectors lost a net 13,400 jobs, predominantly in wholesale and retail trade, real estate, and rental and leasing. Statscan noted that growth in Canada’s population has outpaced employment growth. The economy averaged a monthly employment gain of 28,000 this year, whereas population growth has averaged 80,800. “Employment is still rising, but not fast enough anymore to absorb rapid labor force growth," said assistant chief economist, Nathan Janzen, at Royal Bank of Canada.

Across the Atlantic, British consumers increased the pace of their borrowing in the fourth quarter. According to Bank of England data, consumer credit increased by 8.1%, the highest level since 2018. “Net borrowing by consumers, of just under 1.3 billion pounds, suggested that higher interest rates have not deterred spending by individuals,” said Paul Dales, chief UK economist at Capital Economics. The BoE said lenders approved 47,383 mortgages for house purchases, but the number remained lower than it had been in 2022. "Some of this might be because the cost-of-living crisis has forced some households to borrow to fund necessary spending," Dales added.

The OECD forecasted Germany’s GDP to expand by 0.6% in 2024 and 1.2% in 2025. The Organization for Economic Cooperation and Development (OECD) expects falling inflation and rising wages to support real incomes and private consumption over the next two years. Meanwhile, as high interest rates have weighed down global demand for investment goods, the OECD forecasted the German economy to shrink by 0.1% this year. The government expected the economy to contract by 0.4% in 2023. “It is crucial to resolve the budget crisis as quickly as possible in order to give companies and households planning security and confidence in the future," said OECD economist Isabell Koske.

The French economy contracted by 0.1% in the third quarter, while inflation eased more than expected in November. According to the statistics office INSEE, the contribution of gross fixed capital formation to France’s national output was revised downwards, while domestic demand dropped to 0.2 points. Gross domestic product (GDP) weakened in the third quarter as imports grew. In November, food prices rose 7.6%, while increasing energy prices slowed from 5.2% in October to 3.1%. Despite the economic contraction in the third quarter, the government held on to its 1% growth forecast for this year. "I maintain my growth forecasts. We will have positive growth this year and higher growth in 2024 than in 2023," said Economy Minister Bruno Le Maire.

China’s manufacturing activity contracted for the second consecutive month. The official purchasing managers' index (PMI) ticked down from 49.5 to 49.4 in November, National Bureau of Statistics data showed. Economists had forecasted a reading of 49.7."The domestic market cannot make up for losses in Europe and the United States. The data shows that factories are producing less and hiring fewer people," said Dan Wang, chief economist at Hang Seng Bank China. While the new export orders component extended its decline for the ninth month, the new orders sub-index contracted for the second consecutive month. The non-manufacturing PMI eased from 50.6 to 50.2 in November. "Despite the raft of stimulus measures announced over the past several months, we believe it is still too early to call the bottom," said Ting Lu, chief China economist at Nomura. "We expect another economic dip towards end-2023 and spring 2024,” added Nomura.

Tokyo core CPI growth slowed to 2.5% in November. Core consumer inflation in Japan’s capital grew last month, but at a slower pace than in October. The core consumer price index in Tokyo was expected to have climbed 2.4%, primarily due to falling fuel prices and slower food price increases. Economists had expected the first month-on-month contraction in household spending in October to have been weighed down by price pressures. "Although government subsidies have been halved, electricity and other prices are expected to fall again as crude oil prices peak out, and the momentum of food price hikes is slowing," said Shunpei Fujita, a deputy chief researcher at Mitsubishi UFJ Research and Consulting.

Final thoughts (last but not least):

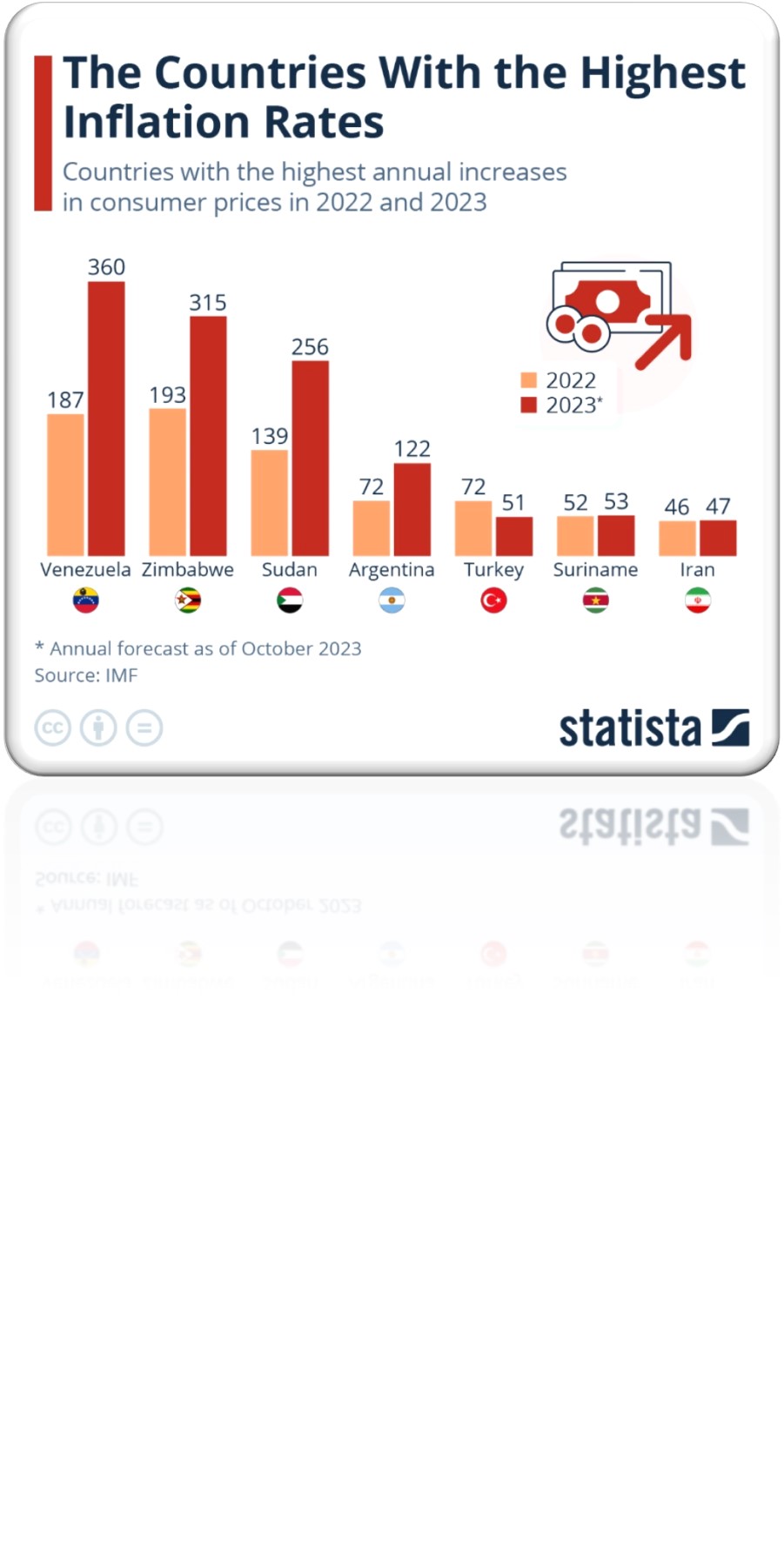

If, like most Americans, you're frustrated by higher prices for just about everything, at least you don't reside in one of these countries. According to figures from the International Monetary Fund (IMF), Venezuela is the country with the highest inflation in the world. Venezuela’s consumer prices had an estimated increase of 360% for 2023. This marks the tenth year in a row that the inflation rate in Venezuela is one of the highest globally. Three other countries are experiencing especially high inflation this year: Zimbabwe, with a rise in consumer prices estimated at 315%, Sudan with 256%, and Argentina seeing an increase of 122%.

Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.