The Next Decade

Healthy expectations for future investment returns will set you up to avoid disappointment and help you determine if potential returns align with your needed returns for your retirement plan.

One tool that may be used to set expectations for future returns is the Shiller Price-to-Earnings (P/E) Ratio, also known as the PE 10 Ratio or Cyclically-Adjusted Price-to-Earnings (CAPE) Ratio.

Price-Earnings ratios can be applied to an individual stock, fund, or index, such as the S&P 500 index.

The standard Price-Earnings Ratio is found by dividing the current price of the investment by 12 months of earnings, either the last 12 months actual earnings or the next 12 months expected earnings.

P/E = Price / Earnings

The CAPE Ratio is found by dividing the current price of the index by the average of 10 years of inflation-adjusted earnings. Using 10 years of earnings helps smooth out the impact of business cycles.

CAPE = Price / Average Earnings for 10 years adjusted for inflation

The CAPE Ratio is used to assess long-term financial performance, while isolating the impact of economic cycles. It is also used to identify potential bubbles and market crashes. Since it’s calculated on a longer view of earnings, it can provide very high readings before events such as the Dotcom Crash and the Great Financial Crisis.

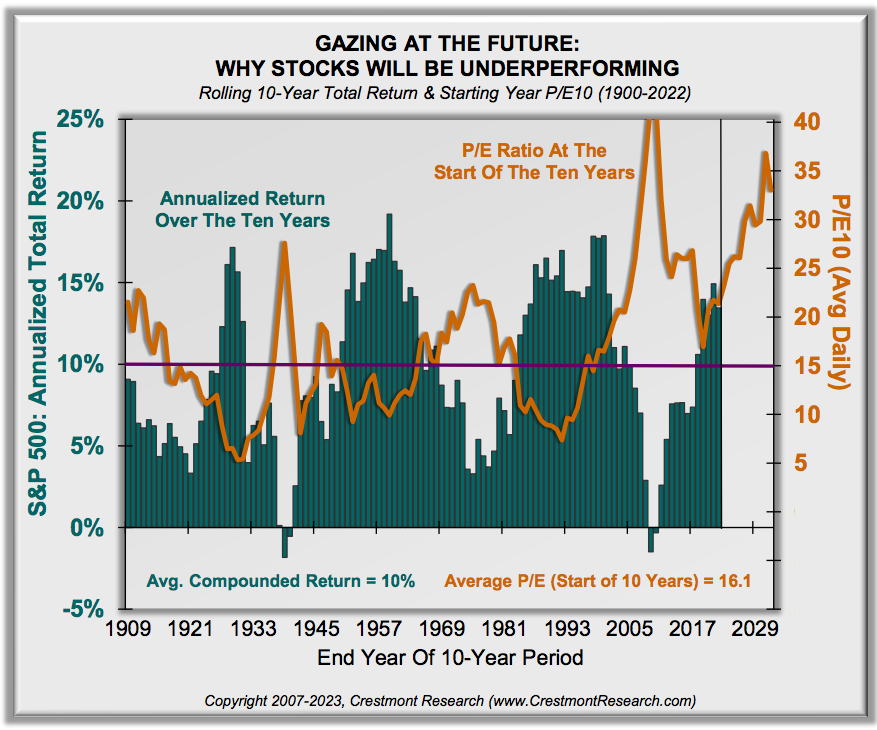

The CAPE Ratio can potentially be used to gauge the expected returns over the coming decade. Crestmont Research produced the below chart showing that there is a very strong correlation between the starting CAPE ratio and the return over the next 10 years. See the chart below:

The CAPE ratio for the S&P 500 is 29.45 (according to https://www.multpl.com/shiller-pe as of 01/23/2023).

Bottom line, the CAPE ratio for the S&P 500 is currently high, which implies that we should expect low returns in the S&P cap-weighted index over the next decade. Some would argue that the changes in calculation of earnings under the GAAP have caused a pessimistic view. Only time will tell.

In summary, the market is shifting, as it always does. What worked the past 10 years may not work as well the next 10 years. It’s time to consider what will work best for you. That may include more active management, more fixed rate options, and more alternatives to fit your specific retirement needs.